Protecting yourself from scams

What is a scam?

Scams are schemes designed to cheat you out of your money. There are a range of scams that can target consumers and businesses, at home or work, and come in the form of a letter, email, telephone call, or a text message.

You can be targeted:

- through the post with offers of prize draws, claims you have won a lottery, and false invoices

- over the phone with advertising schemes and offers to reduce tax

- through your computer with viruses or false offers to remove viruses that don't exist

- by being offered loans by fake lenders, who ask you to pay fees up front via Western Union or similar

- by being misled when buying goods on the internet

- through fake sites or by selling fake goods.

Check out the Metropolitan Police's Little Book of Big Scams (pdf 2MB) for more information.

Recognising scams

There are so many different types of scam, it is difficult to list them all. If you think you have been targeted by a scam ask yourself these questions:

- was the offer unsolicited?

- does it look too good to be true?

- do I have to send money up front?

- do I have to respond immediately?

- do I have to make a purchase to win a prize?

- do I have to ring a premium rate phone number?

- do I have to give my bank or credit card details?

- do I have to send the money to a PO Box number?

- do I have to send money by bank transfer?

- am I asked to keep it confidential?

If the answer to any of these questions is 'yes', you may be the target of a scam. The chances are that once you have sent money, you'll never see it again.

Doorstep crime

What is doorstep crime?

Many scams don't involve face-to-face contact, but sometimes the conmen come to your door. They could be pretending to be from the water board, power company and even the police.

Conmen may pretend your roof needs repair, or that they are officials who need to enter your home.

Some might claim they just happen to be working nearby and have spotted a small problem with the house that can be easily fixed. They then often say they've found more problems, and the final bill can be enormous. They may also target you or your business by letter, email, telephone call, or a text message.

Four steps to protect yourself

We encourage residents to help reduce the amount of doorstep crime in the borough by following four simple steps.

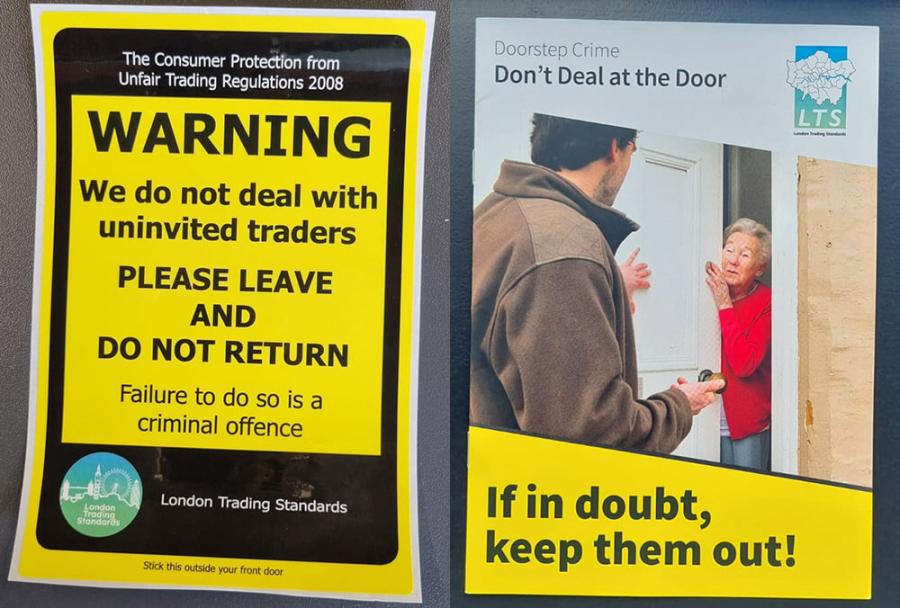

- Display a 'No uninvited traders' sticker – on a flat glass surface on or adjacent to your front door. Even if you feel secure dealing with uninvited traders, if enough stickers are displayed locally, doorstep criminals will be deterred from operating in the area. Also encourage your neighbours to do the same.

- Don't deal at the door. If someone does knock at your door offering goods or services, please decline to deal with them immediately. If they are advertising 'local services' of interest, such as gardening or window cleaning, you can always ask then to leave details and then do some checks to ensure they are reputable.

- Be informed. There is guidance on this page that will help you navigate your way through the surprisingly hazardous process of arranging home maintenance or improvement work. Have a read if you are planning work.

- Look out for your neighbours – especially the vulnerable ones, including elderly and Disabled residents as well as single women. Doorstep criminals are often easier to get money out of through a mixture of misrepresentation, outright lying and intimidation.

If you see anything suspicious, discretely intervene to check your neighbour is okay, or report it to trading.standards@lbhf.gov.uk or to 020 8753 1081.

Don't deal at the door – if in doubt, keep them out!

London Trading Standards guidance

Our work in this area is partly coordinated by London Trading Standards, who give guidance on spotting these rogues. It's your home – with the right precautions, you can keep it safe.

London Trading Standards run an initiative called 'Don't deal at the door' that provides useful advice and 'No cold calling' stickers that can be displayed to discourage such traders. A leaflet is available on the London Trading Standards website to read or download, and you can browse the main London Trading Standards project page.

Please email trading.standards@lbhf.gov.uk or call us on 020 8753 1081 if you want a hard copy or one of the stickers.

There are specific articles for:

- Don't deal at the door

- Who's that knocking at the door?

- Protecting vulnerable neighbours

- Tactics of doorstep criminals

- Finding a tradesperson

- Can ratings be trusted?

- Approved traders

- Are you suspicious? Report it!

How to identify a reliable locksmith

Every year Londoners fall victim to locksmiths who overcharge for very simple jobs – often when they're at their most vulnerable and have been locked out of their homes. There are several steps that can help you avoid these scams:

- If possible, leave spare keys with a trusted neighbour or nearby friend – if you lose your keys, you'll still be able to get in. Or install a key safe, somewhere out of view, to securely keep a spare key accessible.

- Identify a local locksmith in advance of needing one – it's worth finding a reputable business before you need it. Make sure to check whether they offer a 24-hour emergency service.

- Try to avoid using an 'emergency' locksmith – you would reasonably be charged more if you request a visit outside normal working hours. If the work can be delayed, you are less at risk of receiving an expensive bill.

- Do not rely on stickers at the entrances to shared buildings – it is a common practice for rogue locksmiths to display stickers to trick residents in believing the landlord or property manager has put it there to identify their recommended trader.

- Take the time to do some research – the Master Locksmiths Association has guidance about the approach to problems that a skilled locksmith might take and the prices that they consider to be reasonable. A common practice of rogue locksmiths is to 'drill' the lock, destroying it completely, and making the victim even more vulnerable. It is very rare that a skilled locksmith would need to drill a lock.

- Be clear about what you require and ask for a quote first – if you just want to get into your property after locking yourself out, this can usually be done without damaging the lock or the door. If you need new locks, be clear about what you need – either by sharing the insurance company's requirements, or by researching different types of lock yourself.

- Ask for the cost to be broken down – have the locksmith quote for their call-out charge (if there is one), labour and parts.

- Ask to retain the packaging of any new part, so you are clear what was fitted.

- Do not pay the full amount unless it was agreed in advance; or the whole cost has been properly explained and is not excessive – if no price was given, offer a 'reasonable' amount. If the trader refuses to accept this and leave, or is intimidating, call the Police. If possible, it's best to deal with traders outside your home.

Reporting and avoiding scams

Reporting scams

Call Citizens Advice on 0808 223 1133 to report scams and receive advice.

You can also report scams on the Action Fraud website, which has a lot more information on popular scams.

Get help from Friends Agains Scams Friends Against Scams - If You've Been Scammed

Avoiding scams

- Register with the Mailing Preference Service online to cut down on unwanted direct mail that is addressed to you, or call 020 7291 3310.

- The Royal Mail has an opt out scheme allowing you to choose not to have materials, such as letters addressed to 'The Occupier', put through your door.

- Register with the Telephone Preference Service online to cut down on unwanted phone calls, texts and SMS messages, or call 0345 070 0707.

- Forward spam texts to your mobile provider – 7726 for Everything Everywhere (O2 and Orange), 37726 for Three, 87726 for Vodafone.

Help protect against scams Friends Against Scams - Become a Friend

Report a loan shark

Beware of loan sharks

During the cost-of-living crisis, we're aware that vulnerable residents are being offered loans at astronomical rates of interest.

You can report loan sharks to the Illegal Money Lending Team, which is organised by trading standards nationally. Please do not let them prey on you or your loved ones.

The England Illegal Money Lending Team (IMLT) is the government body behind Stop Loan Sharks. The team was set up in 2004 to investigate and prosecute illegal money lenders while supporting those who have borrowed money from a loan shark.

Some of the tell-tale signs of illegal money lending include cash loans without paperwork, use of benefit or bank cards as security and threatening behaviour or violence to get money.

If you've been affected by a loan shark, or know of loan sharks operating in the borough, contact the Stop Loan Sharks 24-hour confidential helpline on 0300 555 2222. You can also text a report to 078600 22116 or visit www.stoploansharks.co.uk. The website provides information on how loan sharks work and will help you avoid them – especially as some masquerade as friends.

Investment scams

Check the FCA warning list if you are thinking of investing, see ScamSmart - Avoid investment and pension scams | FCA

Scams targeting businesses

Tips on protecting your business against scams: Scams targeting businesses

Here are some of the scams against businesses we've encountered – and how to avoid them: Friends Against Scams - Friends Against Scams Organisations

Identity fraud and online safety

Advice on how to keep safe when you are online how to protect yourself against identity fraud

Protect yourself against identity fraud

- Shred documents with your name, address or financial details.

- If you receive an unsolicited email or phone call from what appears to be your bank or building society asking for your security details, never reveal your full password, login details or account numbers. Most banks will not approach their customers in this manner.

- If you are concerned about the source of a call, hang up and call your bank, or whoever is supposedly calling you, on a legitimate number printed on your bank statements or other documents.

- Check statements carefully and report anything suspicious.

- If you are expecting a statement and it doesn't arrive, tell your bank.

- If you move house, always get Royal Mail to redirect your post.

- Notify your bank immediately of any unusual activity on your account.

For more advice about online safety visit the Get Safe Online website.

Friends Against Scams (FAS)

Friends Against Scams is a National Trading Standards Scams Team initiative which aims to protect and prevent people from becoming victims of scams by empowering people to take a stand against scams. Visit their website for more information Friends Against Scams - About

FAS downloadable resources

- Friends Against Scams guide (pdf)

- No cold calling sticker (pdf) This sticker can be printed off and stuck on your fron door to deter traders knocking on your door.

- Friends Against Scams (pdf) Easy Read A scams awareness guide that has been created in an Easy Read version.